Advancing client engagement through digital innovation

The Swiss private bank embarked on a strategic initiative to overhaul its digital infrastructure, aiming to introduce state-of-the-art e-banking and mobile banking solutions.

We designed the application with the following key considerations in mind:

- Security and Privacy

- Focus on Managing Complex Financial Portfolios

- Regulatory Compliance

- Concierge-Level Service

- Technology Integration

Designing an application that can handle a wide array of investment instruments, asset classes, and financial planning tools while ensuring ease of use is a delicate task.

We broke the challenge down into a series of discrete but interconnected user flows:

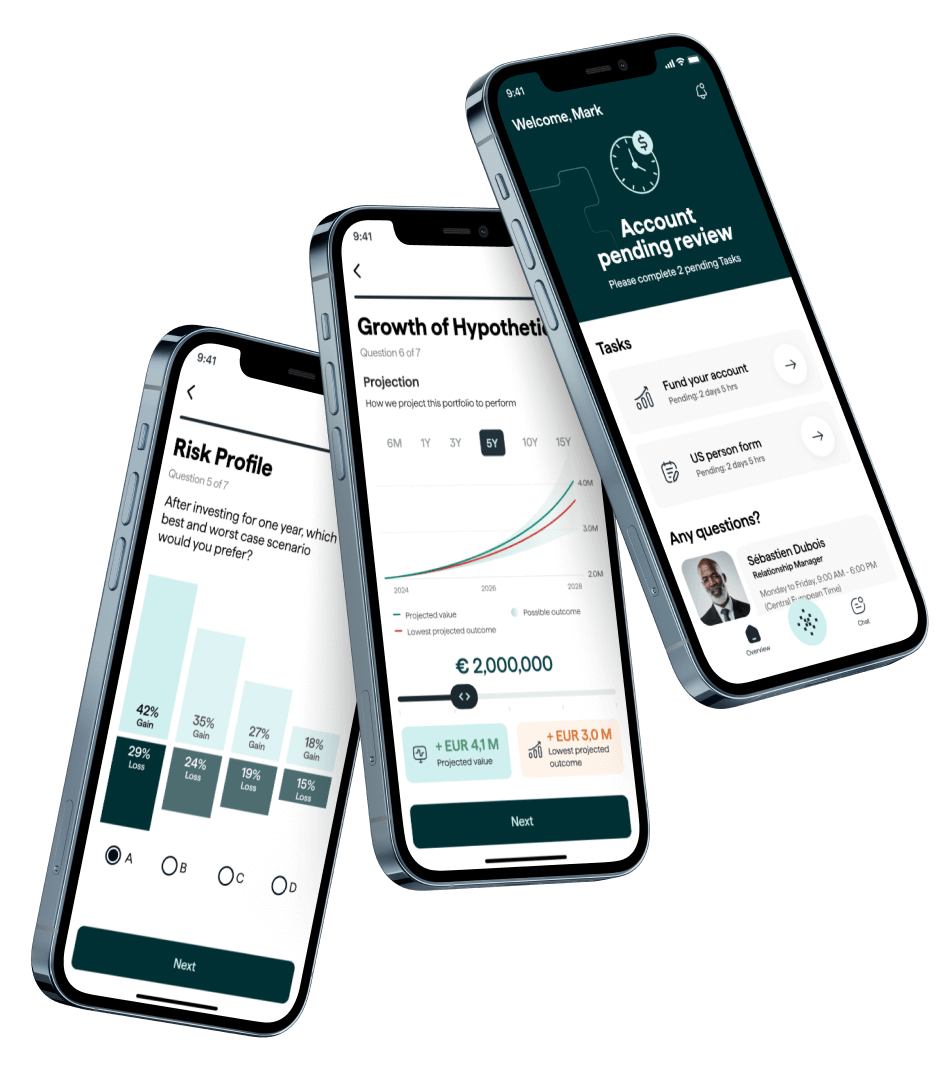

Simplified Digital Onboarding

The onboarding redesign focused on a paperless, efficient digital capture of personal details and risk profiles. It streamlined client entry with an intuitive interface for data input and created personalized risk assessments to inform investment strategies.

Account Activation and Support

We wanted a seamless account opening to be coupled with meticulous monitoring and dedicated support. Once accounts are active, clients receive continuous oversight and direct access to advice, ensuring a guided experience in managing their financial portfolios.

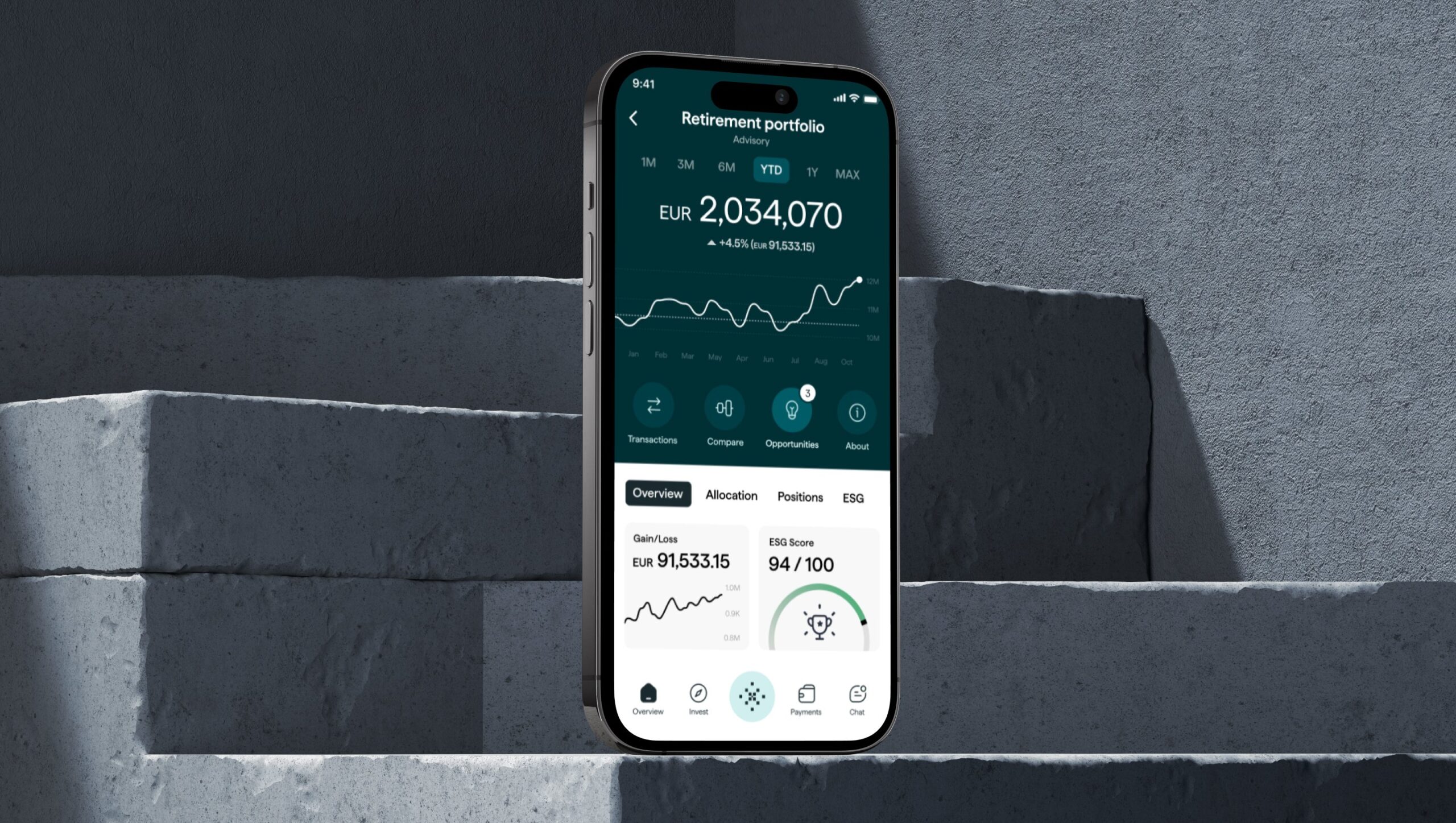

Investment Objectives & Portfolio Customization

We designed dynamic tools for clients to tailor their investment strategies. The experience enabled clients to engage with various financial scenarios and make well-informed decisions, supported by real-time analytics and market insights.

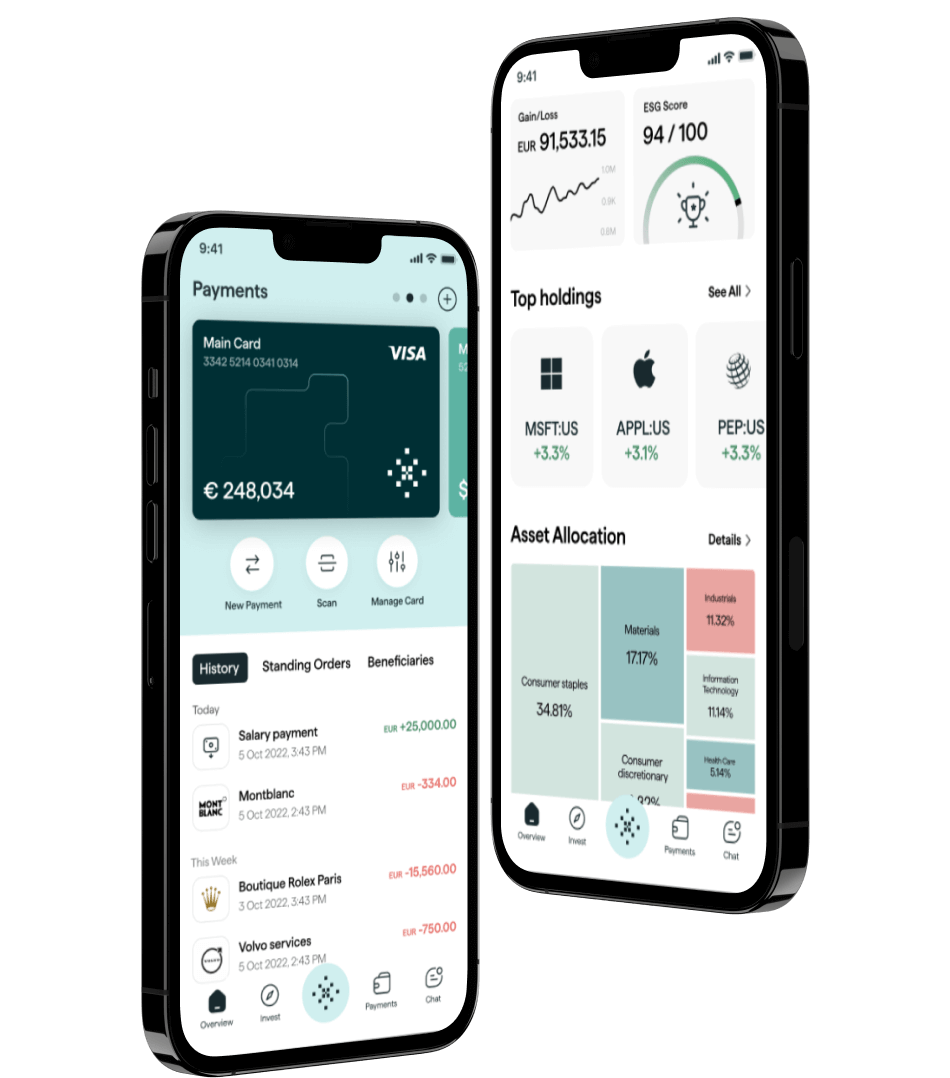

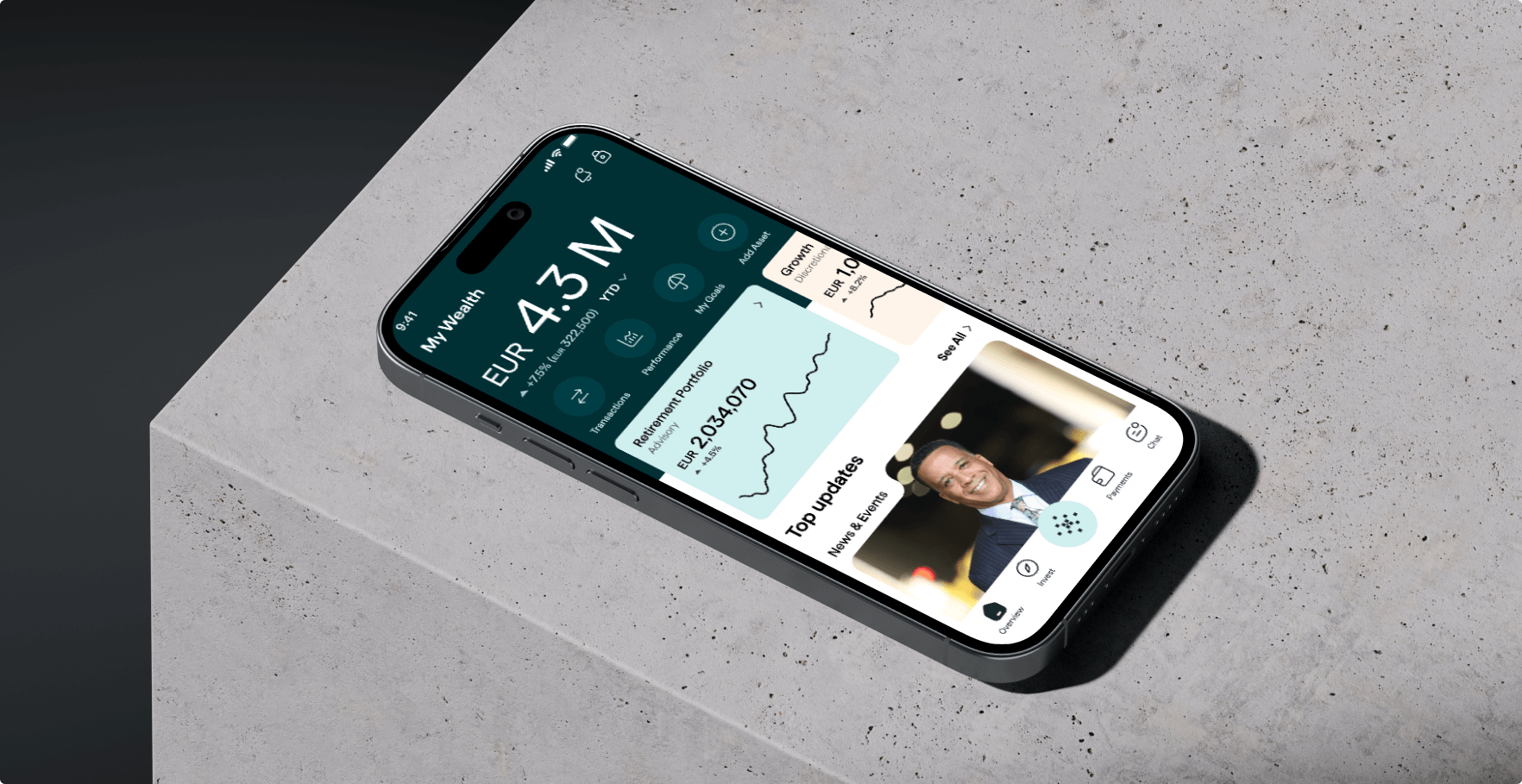

Wealth Overview and Analytics

We created eye-catching, comprehensive wealth overviews with real-time analytics, providing insights into the financial standing and performance of investments.

Personalized Dashboards

Customizable dashboards gave users the ability to view and manage their diverse financial portfolios, including investments, assets, and liabilities.

Advanced Security Measures

The designs incorporated enhanced security features, such as biometric authentication and multi-factor authentication, to ensure the protection of sensitive financial data and transactions.

Impact

Our team’s comprehensive approach resulted in the desired transformative impact on the bank’s digital landscape. By spearheading an extensive user-centric overhaul and by collaborating successfully with the bank’s partners we helped establish a new benchmark in digital banking, reinforcing the bank’s position as a contemporary innovator committed to exceptional client engagement and operational excellence.